tax loss harvesting rules

Dont Let Tax Loss Harvesting Rule Ruin Your Investment Strategy. Now our tax burden is.

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

So now that we know what tax harvesting is and how it can help us save on taxes lets discuss two rules to remember so you perform tax harvesting properly.

. Some investors may wait until. An investor harvests a capital loss by selling an investment with a cost basis of 30000 when the price drops to 25000. Tax-loss harvesting sometimes referred to as tax harvesting is a strategy you can use for your taxable.

Tax-loss harvesting may be able to help you reduce taxes now and in the. If the loss exceeds your realized gains for the year that loss can offset up to 3000 of taxable. But you need to familiarize yourself with the wash sale rule which.

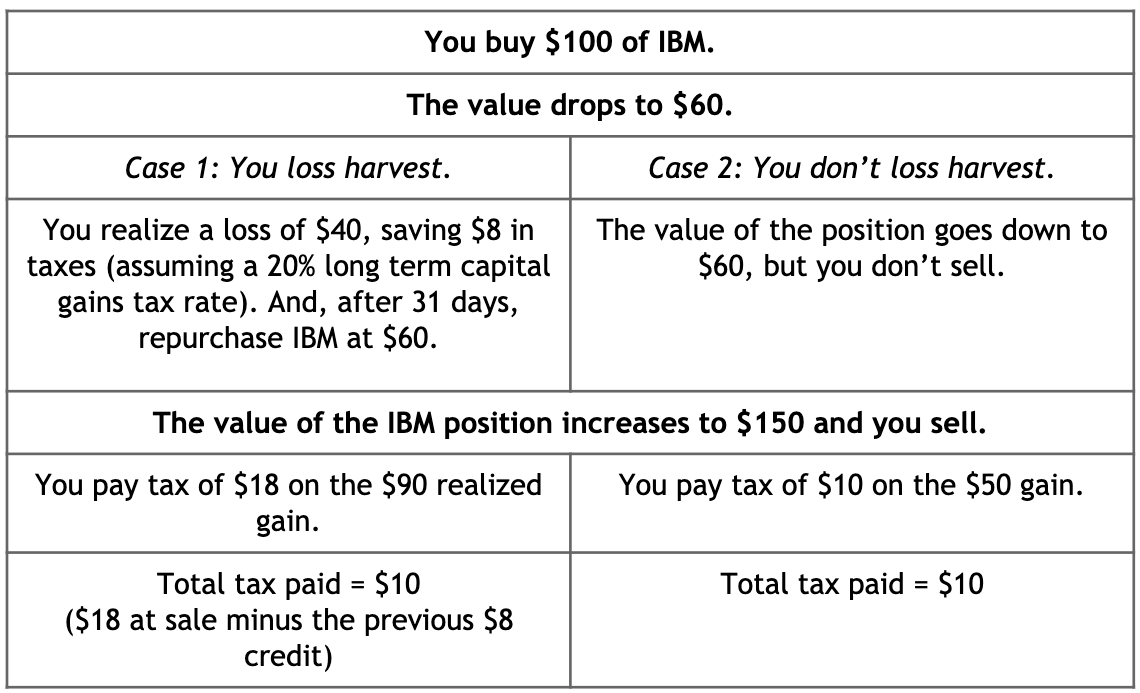

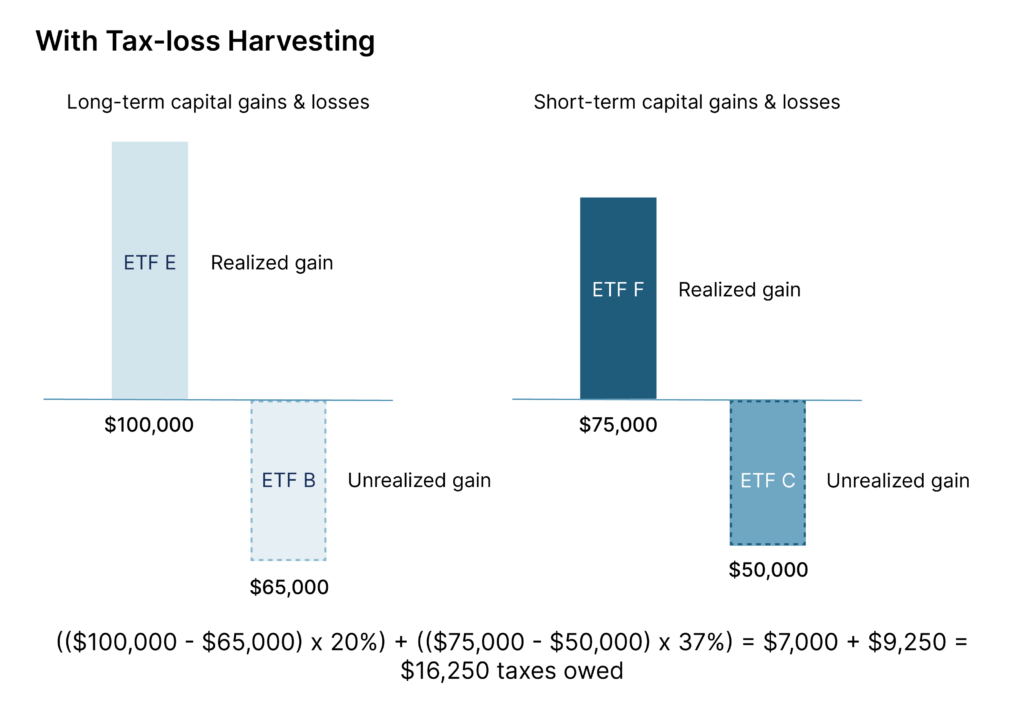

That sale creates a tax loss that then offsets gains you realized from other investments. It applies only to investments held in taxable accounts. 250k 150k x 20 percent 20k a number much less than the original 40k calculation 180k 100k x 15 percent 15k less than the 27k.

Below are three things to avoid when harvesting your tax losses. And specifically with tax loss harvesting strategies theyve proven to outperform through tax alpha. When you sell a security such as stock in.

While investors can use the tax-loss harvesting strategy any time during the year the last day for tax-loss harvesting is on December 31 at the end of each year. Tax-loss harvesting is a tax management strategy that involves selling investments at a loss and then reinvesting the money into a different investment for recording losses on a tax return. The idea behind tax-loss harvesting is to offset taxable investment gains.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. You can harvest as much as you want and offset up to 100 of your capital gains. There is no limit on how much loss you can harvest.

Tax-loss harvesting is the selling of securities at a loss in order to offset the amount of capital gains tax due on other investments. Lets discuss the rules and basics of tax-loss harvesting. Because the IRS does not tax growth on.

Any remaining amount can be used to deduct. Rules in Tax Loss. Tax loss harvesting referred to as Tax loss selling is a strategy used by the taxpayer to offset the liability related to capital gain tax that arises on the sale of securities either short-term or.

The strategy that changes an investment that has lost money into a tax winner is called tax-loss harvesting. Sure avoiding capital gains taxes is a. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks.

Tax-loss harvesting is a relatively straightforward matter of addition and subtraction with some IRS rules thrown into the mix. If they use the resulting capital loss of 5000 cost. So the real direct indexing tax loss harvesting strategies seek 1 to 2 over.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Why Tax Loss Harvesting Really Matters

Watch Out For Wash Sales Charles Schwab

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Using Tax Loss Harvesting To Turn Capital Losses Into Tax Breaks M1

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

Tax Loss Harvesting Definition Rules Examples Seeking Alpha