jefferson parish property tax rate

Most millage rates are approved when voted upon by voters of Jefferson Parish. Please contact the Jefferson Parish Sheriff 504-363-5710.

Property Tax Overview Jefferson Parish Sheriff La Official Website

Whether you are presently.

. Jefferson Parish Wards. If a Homestead Exemption HEX. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

If you do not pay your. A mill is defined as one-tenth of one cent. 1233 Westbank Expressway Harvey LA 70058.

Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate. Property taxes are levied by millage or tax rates. Lafayette Parish 583 Tax Assessor.

This gives you the assessment on the parcel. Overview of Jefferson Parish LA Property Taxes. Bldg 200 Derbigny St Suite 1100 Gretna LA 70053 504-362-4100 504-366-4087 EAST BANK OFFICE Yenni Bldg.

The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property. Jefferson Davis Parish -1 Tax Assessor. Jefferson Parish Property Search.

The preliminary roll is subject to. The tax is due on December 31st of each year. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a.

Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street. Jefferson Parish Sheriffs Office. Jefferson Parish Sheriffs Office.

Utilize our e-services to. You must submit your change of address in writing to the address below. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county.

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. 2021 Plantation Estates Fee 50000. If you are planning to buy a home in Jefferson Parish and want to understand the size of your property.

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of. Jefferson Parish Assessors Office. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

Jefferson Parish collects on average 043 of a propertys. Lafourche Parish 390 Tax Assessor. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Only open from December 1 2021 - January 31 2022. The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Jefferson Davis Parish collects on average -1 of a propertys.

Administration Mon-Fri 800 am-400 pm Phone. Jefferson Parish 755 Tax Assessor. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Online Property Tax System. With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. WEST BANK OFFICE General Govt.

For comparison the median home value in Jefferson Parish is. La Salle Parish -1 Tax Assessor.

Jefferson Parish Teachers Get Long Awaited Raise Wwltv Com

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Cities Towns Jefferson Parish Sheriff La Official Website

Louisiana Property Tax Calculator Smartasset

Jefferson Parish The Department Of Inspection And Code Enforcement Will Not Charge Any Permit Or Trades Filing Fees Related To Hurricane Ida Until December 31 2021 Jefferson Parish Residents Are Reminded

About Assessors Louisiana Assessors Office

Jefferson Parish Assessor S Office Millages Wards

Jefferson Parish Louisiana Home

Jefferson Parish Assessor S Office Tax Estimate

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

Jefferson Parish Consolidated Plan Executive Summary

Jefferson Parish Louisiana Home

Louisiana Property Taxes By County 2022

Cliff Notes Louisiana Is Still A Low Tax State Louisiana Budget Project

Louisiana Property Taxes Taxproper

Bail Bonds In Jefferson Parish La Ultimate Guide

Poll Taxes In The United States Wikipedia

Jefferson Parish Looks For Developers To Help Revitalize Fat City New Orleans Citybusiness

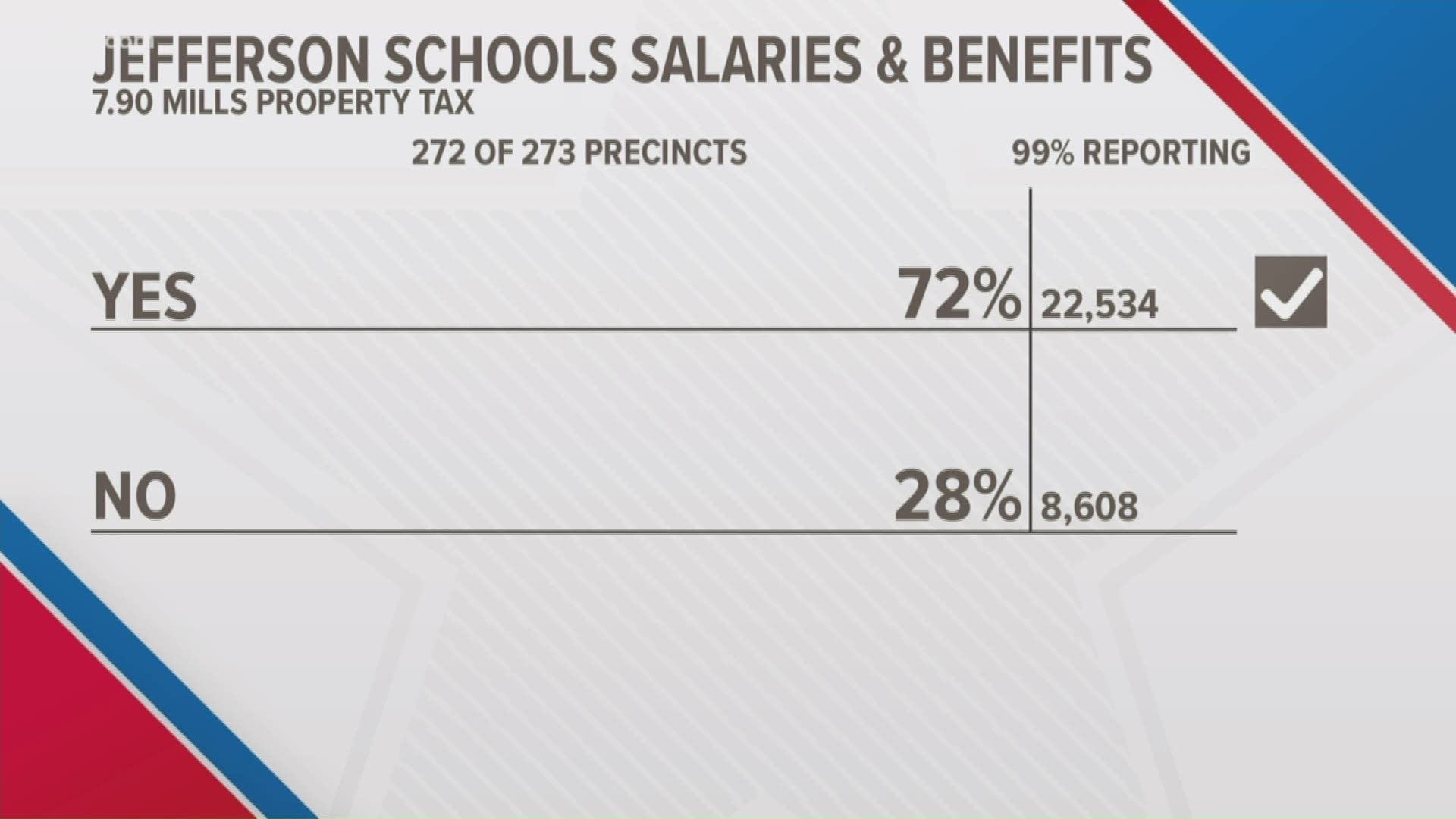

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools